Affluent Savvy

Affluent Savvy

Affluent Savvy

Affluent Savvy

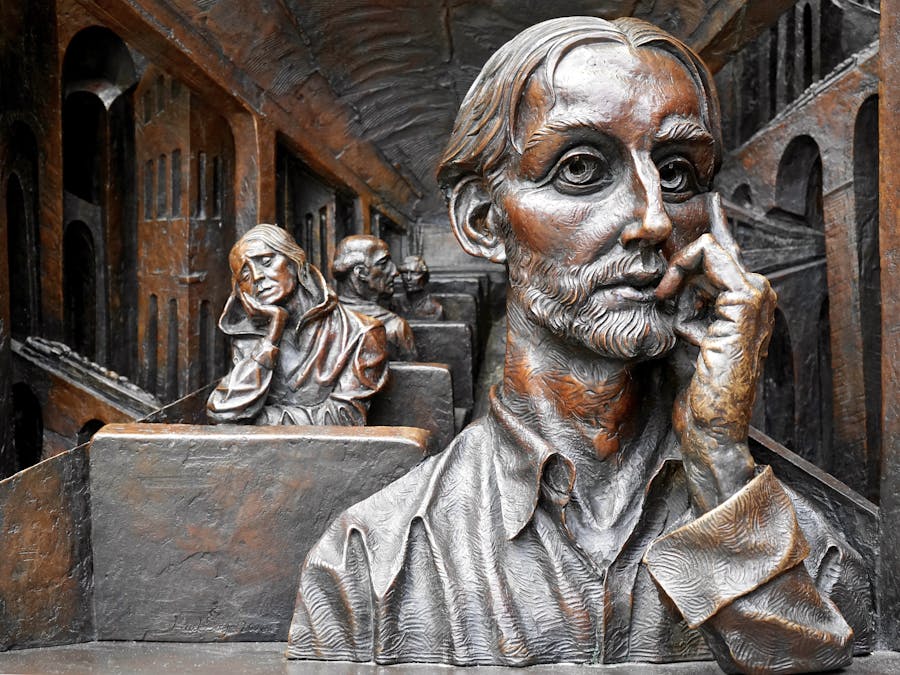

Photo: elifskies

Photo: elifskies

The 80/20 budgeting method is a common budgeting approach. It involves saving 20% of your income and limiting your spending to 80% of your earnings. This technique allows you to put savings first, and it's both flexible and easy.

God, I stand in financial need, but your word declares that you are an ever-present help in time of need (Psalm 46:1). I thank you that you are...

Read More »

Studies conducted by Joanne Wood, a professor of psychology at the University of Waterloo show that the use of affirmations, or positive self-...

Read More »

The simple yet scientifically proven Wealth DNA method laid out in the report allows you to effortlessly start attracting the wealth and abundance you deserve.

Learn More »Many or all of the products here are from our partners that pay us a commission. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Terms may apply to offers listed on this page.

Conventional wisdom suggests that richer individuals put more of their assets toward high risk investments, which can result in higher returns. But...

Read More »

To boost self-confidence, wake up early in the morning and worship the rising sun. Recite 'Aditya Hriday Srota' on a regular basis. Offering water...

Read More »

The simple yet scientifically proven Wealth DNA method laid out in the report allows you to effortlessly start attracting the wealth and abundance you deserve.

Learn More »Another big benefit of the 80/20 budget is its simplicity. There's no need to make a list of dozens of different things you spend money on each month when you make this type of budget. And there's no need to try to decide in advance if you're going to spend more on entertainment and less on dining out or clothing or vice versa. As long as you're prioritizing saving first as the budget calls for, and you don't find yourself spending too much and going into debt, you can be financially successful with this budget without a lot of hassle.

4 Common manifesting mistakes Expecting instant results. Lacking clarity in what you want. Remaining rigid in your desired outcome and pathway to...

Read More »

When a priest has no blessed oil and a grave need occurs, Canon 999 provides him with a solution so that nobody might be deprived of the grace of...

Read More »

6 Steps to Become a Millionaire by 30 Start Saving Early. The easiest way to build your savings is to start early. ... Avoid Unnecessary Spending...

Read More »

The simple yet scientifically proven Wealth DNA method laid out in the report allows you to effortlessly start attracting the wealth and abundance you deserve.

Learn More »

Data collected by Betway Insider has revealed the average age to become a millionaire is only 37. Becoming a first time billionaire takes a bit...

Read More »