Affluent Savvy

Affluent Savvy

Affluent Savvy

Affluent Savvy

Photo: Brett Sayles

Photo: Brett Sayles

The Rule of 78 is a financing method that allocates pre-calculated interest charges that favor the lender over the borrower on short-term loans. This financing practice is highly controversial and in 1992, was outlawed in the United States for loans longer than 61 months.

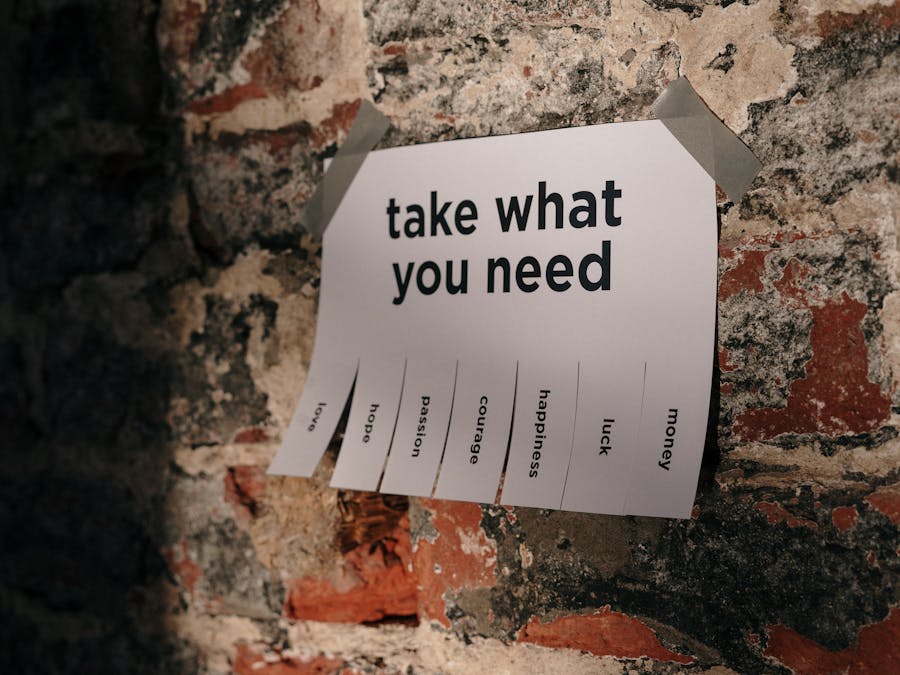

19 Ways to Find Fast Cash Sell spare electronics. ... Sell your gift cards. ... Pawn something. ... Work today for pay today. ... Seek community...

Read More »

That's why the trick to arguing with a Virgo is to not give them too much information upfront or you'll be debating for hours. Instead, try making...

Read More »

The simple yet scientifically proven Wealth DNA method laid out in the report allows you to effortlessly start attracting the wealth and abundance you deserve.

Learn More »The Rule of 78 is a financing method that allocates pre-calculated interest charges that favor the lender over the borrower on short-term loans. This financing practice is highly controversial and in 1992, was outlawed in the United States for loans longer than 61 months. Individual states have their own laws for loans shorter than 61 months and 17 states outlawed it completely. Financial analysts believe the Rule of 78, also known as “pre-computed loans” is unfair to consumers because it penalizes anyone who pays off a loan early, though the penalty is really not that severe. For example, if you have a 24-month, $10,000 simple interest loan at 5% and decide to pay it off after just 12 months, you would save a total of $4.48 over what you would pay if you used a Rule of 78 loan with the same conditions. Lenders who promote this method are usually involved in sub-prime, used automobile business. Dealerships that advertise “Buy Here, Pay Here” financing are prime locations. If you hear salesmen mention things like “refund” or “rebate of interest” when discussing loan terms, be skeptical about what comes next. You likely are being challenged to know that a “pre-computed loan” is being offered and it could cost you, if you pay the loan off early.

finance and investment profession In broader terms, the finance and investment profession has the most millionaires. It also has the most...

Read More »

Mindfulness-based clinical interventions such as Mindfulness-Based Stress Reduction (MBSR) typically recommend practicing meditation for 40-45...

Read More »

The simple yet scientifically proven Wealth DNA method laid out in the report allows you to effortlessly start attracting the wealth and abundance you deserve.

Learn More »These days, nearly all car loans are calculated using simple interest loans, which is calculated by multiplying the principal x the daily interest rate x the number of days between payments. So, if you borrow $10,000 to purchase a car at 5% interest, you will pay a total of $ 529.13 in interest, whether you use a simple interest loan or a Rule of 78 Loan. On a simple interest loan, the amount of interest is amortized each month, meaning the amount of interest paid each month changes because it’s based on the amount of principal, which declines with each payment. The interest paid the first month is $41.67 and it goes down each month, until you pay just $1.82 the final month. If you pay the car off 12 months early, you would pay 389.29 of interest. Compare that to a two-year Rule of 78 Loan on $10,000 at 5% interest. First, you take the simple interest value of the loan over two years at 5%, which is $529.13. Then add the 24 digits (1+2+3+4 and so on up to 24) and your total is 300. Now multiply the amount of interest ($529.13) times the sum of digits and apply in reverse proportion. So, the first payment would be 529.13 x (24 divided by 300) = $42.33, which is the amount of interest you would pay the first month. The second month would be 529.13 x (23 divided by 300) = $40.56. The third month would be 529.13 x (22 divided by 300) = $38.80 and so on. Using the Rule of 78 Loan, you would have paid $391.50 of interest after 12 months. Using a simple interest loan, you would have paid $389.29, a difference of $2.21. The payoff amount for the simple interest loan after 12 months would be $5,124.71. The payoff amount for the Rule of 78 loan would be $5,126.98, a difference of $2.27. The total amount saved would be $4.48.

In some religions, an unclean animal is an animal whose consumption or handling is taboo. According to these religions, persons who handle such...

Read More »

LAM-VAM-RAM-YAM-HAM-OM-(silence) Use the bija mantras, or one-syllable seed sounds, to stimulate and unblock each chakra. Respectively, each sound...

Read More »

The simple yet scientifically proven Wealth DNA method laid out in the report allows you to effortlessly start attracting the wealth and abundance you deserve.

Learn More »There are certain terms that borrowers need to be familiar with when considering entering into an agreement using pre-computed financing methods. Understanding these terms will help consumers make a more educated decision about how they choose to enter into a binding financial agreement. Lender: A person or organization that gives money to a borrower with the expectation that the money will be repaid in an agreed upon time frame. A person or organization that gives money to a borrower with the expectation that the money will be repaid in an agreed upon time frame. Borrower: A person or company that receives money from another party with the agreement to pay the money back, usually with interest, over a specific period of time. A person or company that receives money from another party with the agreement to pay the money back, usually with interest, over a specific period of time. Repayment: The act of paying off debts. The act of paying off debts. Interest: Money that is paid in exchange for borrowing money- the interest is calculated as a percentage of the month borrowed. Money that is paid in exchange for borrowing money- the interest is calculated as a percentage of the month borrowed. Principal: The actual amount of money borrowed. The actual amount of money borrowed. Amortize: The proportion of interest paid vs. principal paid that changes every month.

In 97 percent of these falls/drops, babies experienced injuries to the head. Around 14 percent resulted in visible injuries (so, ones you can see),...

Read More »

The diamond rain phenomenon is believed by some scientists to take place on Uranus and Neptune in our solar system. It is thought it exists some...

Read More »

The simple yet scientifically proven Wealth DNA method laid out in the report allows you to effortlessly start attracting the wealth and abundance you deserve.

Learn More »

Monoamniotic-monochorionic Twins These types of twins share a chorion, placenta, and an amniotic sac. This is the rarest type of twin, and it means...

Read More »

The simple yet scientifically proven Wealth DNA method laid out in the report allows you to effortlessly start attracting the wealth and abundance you deserve.

Learn More »

Baking soda and hydrogen peroxide Using a paste made of baking soda and hydrogen peroxide is said to remove plaque buildup and bacteria to get rid...

Read More »